Unlocking Performance: The Rise of Third-Party Managers in Insurer Portfolios

August 21, 2024

By Matt Reilly, Head of Insurance Solutions, and Lauren Forando, Senior Analyst

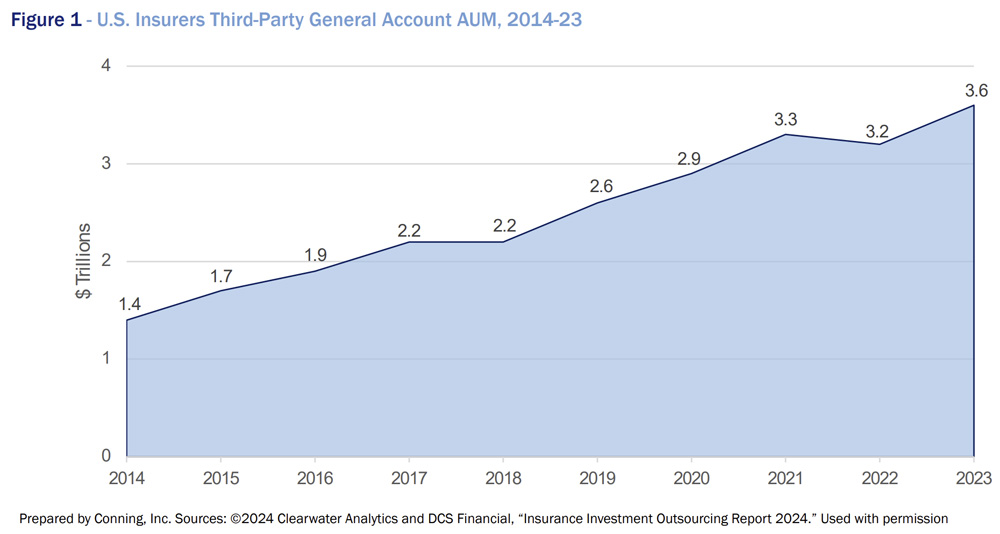

As the evolution in capital markets, regulations and stakeholder requirements increase the complexity of insurance company general account management, insurers have also been making their investment programs more sophisticated. These are some of the reasons insurers have continued to grow their relationships with asset managers (see Figure 1).

Conning’s annual survey of insurance executives and our ongoing dialogue with insurers suggest the outsourcing trend will continue to grow. However, insurers’ demands are changing: they want asset managers to go beyond simply looking for competitive return streams. They want managers to provide customized strategies and unique capital-efficient structures and become true business partners. Insurers are measuring outsourcing success by how it helps them manage efficient investment programs with diversified investment strategies that provide competitive returns, allowing them to free up resources to develop other valuable business capabilities.

Click below to continue reading Conning’s Viewpoint, “Unlocking Performance: The Rise of Third-Party Managers in Insurer Portfolios."

Disclosure

©2024 Conning, Inc. This document and the software described within are copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning & Affiliates. Conning & Affiliates do not make any warranties, express or implied, in this document. In no event shall any Conning & Affiliates company be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice.

This document contains information that is confidential or proprietary to Conning & Affiliates. By accepting this document you agree that: (1) if there is any preexisting contract containing disclosure and use restrictions between you or your company and any Conning & Affiliates company, you and your company will use the information in this document in reliance on and subject to the terms of any such pre-existing contract; or (2) if there is no contractual relationship between you and your company and any Conning & Affiliates company, you and your company agree to protect the information in this document and not to reproduce, disclose or use the information in any way, except as may be required by law.

ADVISE®, FIRM®, GEMS®, CONNING CLIMATE RISK ANALYZER® and CONNING ALLOCATION OPTIMIZER® are registered trademarks of Conning, Inc. in the U.S. Copyright 1990-2024 Conning, Inc. All rights reserved. ADVISE®, FIRM®, GEMS®, CONNING CLIMATE RISK ANALYZER® and CONNING ALLOCATION OPTIMIZER® are proprietary software published and owned by Conning, Inc.

This document is for informational purposes only and should not be interpreted as an offer to sell, or a solicitation or recommendation of an offer to buy any security, product or service, or retain Conning for investment advisory services. The information in this document is not intended to be nor should it be used as investment advice.

COD00000352