Private Placements: Aiming for Greater Yields, Downside Protection and Customized Cash Flows

September 24, 2024

By Cindy Beaulieu, Chief Investment Officer, John Petchler, CFA, Director, Private Placements, and Sam Otchere, Director, Private Placements

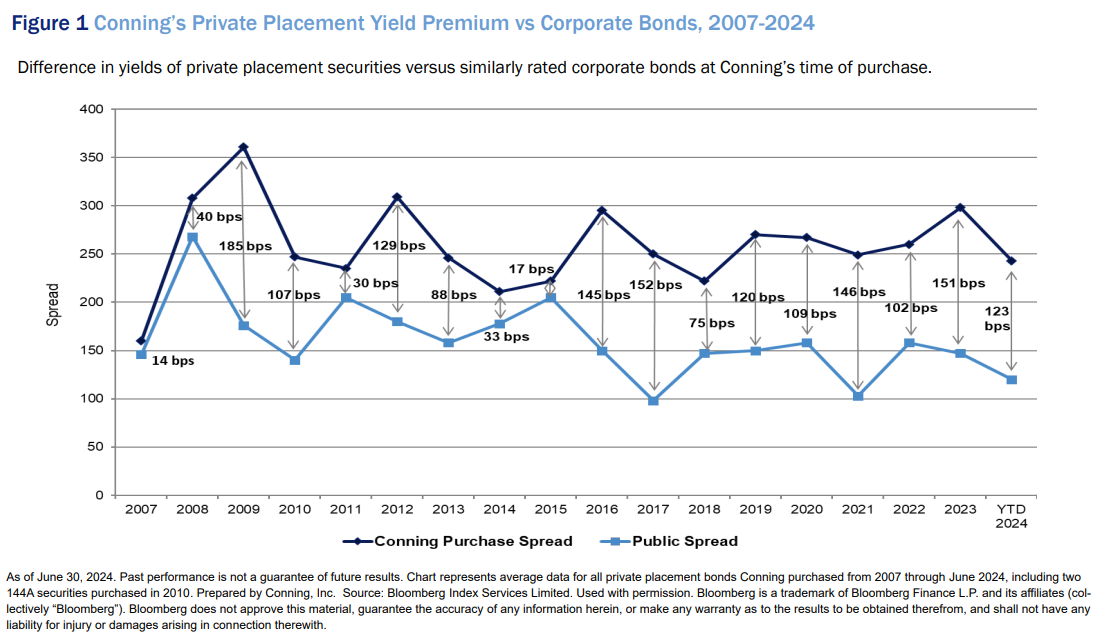

Private placement securities may provide attractive opportunities for insurance companies to enhance portfolio income.1 They typically are rated investment grade and provide higher yields and stronger investor protections than are available in public securities with similar ratings and maturities.

Private placements are typically illiquid, but many insurers may be able to trade some of their current portfolio liquidity to potentially capture additional yield. Larger insurers generally have greater exposure to this sector and have effectively addressed liquidity issues. Small- to mid-sized insurers may be able to leverage opportunities in private placements by working with investment managers that can help them assess their liquidity needs and have the requisite experience, capabilities and access to deal flow.

Private placements offer a wider variety of maturities than are normally available in public debt, which may enable insurers to customize maturities to match their liabilities. In addition, this asset class may be able to provide portfolio diversification, as it includes both U.S. and non-domestic issuers that generally are not active in U.S. public debt markets.

Click below to continue reading Conning’s Viewpoint, “Private Placements: Aiming for Greater Yields, Downside Protection and Customized Cash Flows."

About Conning

Conning (www.conning.com) is a leading investment management firm with a long history of serving the insurance industry. Conning supports institutional investors, including insurers and pension plans, with investment solutions, risk modeling software, and industry research. Founded in 1912, Conning has investment centers in Asia, Europe and North America. Conning is part of the Generali Group.

©2024 Conning, Inc. This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning. Conning does not make any warranties, express or implied, in this document. In no event shall Conning be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice.

This document is for informational purposes only and should not be interpreted as an offer to sell, or a solicitation or recommendation of an offer to buy any security, product or service, or retain Conning for investment advisory services. The information in this document is not intended to be nor should it be used as investment advice.

Disclosures:

Past performance is not a guarantee, predictor or indication of future results. Similar investments likely would produce different results under different economic and market conditions.

Footnote:

1 Insurers must be qualified institutional buyers with at least $100 million in assets under management to invest in private placements.

Additional Source Information:

Copyright 2024, S&P Global Market Intelligence. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

Risks:

Market Risk – Market, or systematic, risk is the risk that individual securities may be correlated with general market downturns regardless of the particular business conditions and outlook for the individual companies

Credit Risk – Eroding fiscal health in issuing companies resulting in inability to meet debt obligations

Inflation Risk – Inflation erodes the purchasing power of future cash flows from investments. In times of high inflation the value of securities may be reduced

Liquidity Risk – Liquidity risk can occur when market conditions do not allow transactions to be made in a quick and orderly fashion in relation to indicative market prices

COD00000404