The Value of Commercial Real Estate in Insurers' Portfolios

August 21, 2023

By Matt Reilly, Managing Director, Insurance Solutions

Let every man divide his money into three parts, and invest a third in land, a third in business and a third let him keep by him in reserve – The Talmud

Even thousands of years ago, humankind understood the role real estate played in a well-balanced investment strategy. What was not foreseen was the evolution of capital markets and the unique investment constraints insurers now face as they balance generating sufficient income to meet obligations and provide their portfolios growth to build long-term surplus.

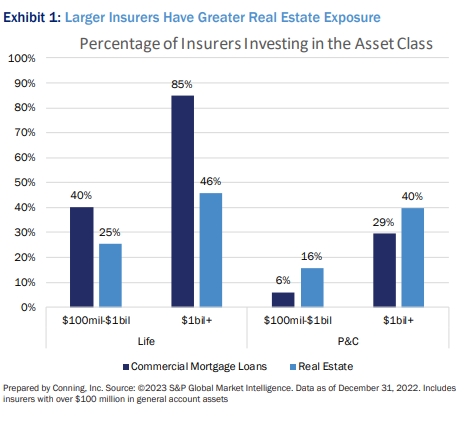

Real estate investments can help insurers with these objectives - and larger insurers have utilized this strategy for decades (see Exhibit 1). Small and mid-size insurers have been less active in real estate and could benefit from a better understanding of the sector, its role in insurance portfolios, and the types of real estate investments that are appropriate for insurers.

Insurers unfamiliar with real estate may be hesitant to add the asset to their portfolio mix, but Conning thinks that could be a missed opportunity. Our knowledge of real estate and experience in partnering with insurers can be of significant value in helping build more diversified portfolios and growing their businesses.

Too Large an Asset Class to Ignore

The U.S. commercial real estate (CRE) market is estimated to be about $21 trillion1 or nearly half the size of the U.S. stock market.2 Most investors looking to build a broadly diversified investment portfolio would likely want to include commercial real estate, and it has consistently been an allocation among a broad array of institutional portfolios for the last three decades.

The CRE market includes various property types (multifamily, industrial, retail, self-storage, office, etc.), geographies and transactions. All real estate cannot be lumped into one monolithic asset class, as within the same segment and even within similar property types, the underlying economic drivers of a transaction can vary – and so can expected risk and return. Property types and markets matter!

Click below to continue reading Conning’s Viewpoint, “The Value of Commercial Real Estate in Insurers' Portfolios."

Footnotes

1 Source: (c) 2023 National Association of Real Estate Investment Trusts, “Estimating the Size of the Commercial Real Estate Market in the U.S.,” https://www.reit.com/data-research/ research/nareit-research/estimating-size-commercial-real-estate-market-us-2021, data as of June 30, 2021, accessed August 1, 2023, used with permission.

2 Source: (c) 2023 Siblis Research LTD., “Total Market Value of the U.S. Stock Market,” https://siblisresearch.com/data/us-stock-market-value/#:~:text=The%20total%20market%20 capitalization%20of,about%20OTC%20markets%20from%20here., data as of June 30, 2023, accessed August 1, 2023.

Disclosure

©2023 Conning, Inc. This document and the software described within are copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning. Conning does not make any warranties, express or implied, in this document. In no event shall Conning be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice. This opinion is published by Conning, Inc., and represents the opinion of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice or a solicitation. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, Global Evolution Holding ApS and its group of companies, and Pearlmark Real Estate, L.L.C. are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning has investment centers in Asia, Europe and North America.

Risk of CRE Investment

All real estate investments are speculative and involve substantial risk. There can be no assurances that all or any of the projections will be true or that actual performance of any real estate investment will bear any relation to the projections or other hypothetical illustrations provided by Conning and no guarantee or representation is made that investment objectives of any strategy or fund will be achieved In the event that actual performance is below projections. Investors’ investment could be materially and adversely affected, and there can be no assurance that any investor will not suffer significant losses. A loss of part or all of the principal value of a real estate investment may occur. All prospective investors should not invest unless such prospective investor can readily bear the consequences of such loss Please see and carefully review the investment documents for additional information concerning any specific real estate investment, including an issuer’s discussion concerning risk factors.

C: 17253607